This article was published in The Citizen Newspaper, Tanzania on 28th March 2023.

Money occupies a very important position in the daily activities of society. Sociologists establish that money, in its very creation is a social relationship.

It is not a neutral or a mere technical medium which interfaces with society’s rational side, but rather everything about it is explained in terms of the relationship between people and the values they assign to things and services. Karl Marx, a prominent German economist and sociologist says money is a product of a commodity economy.

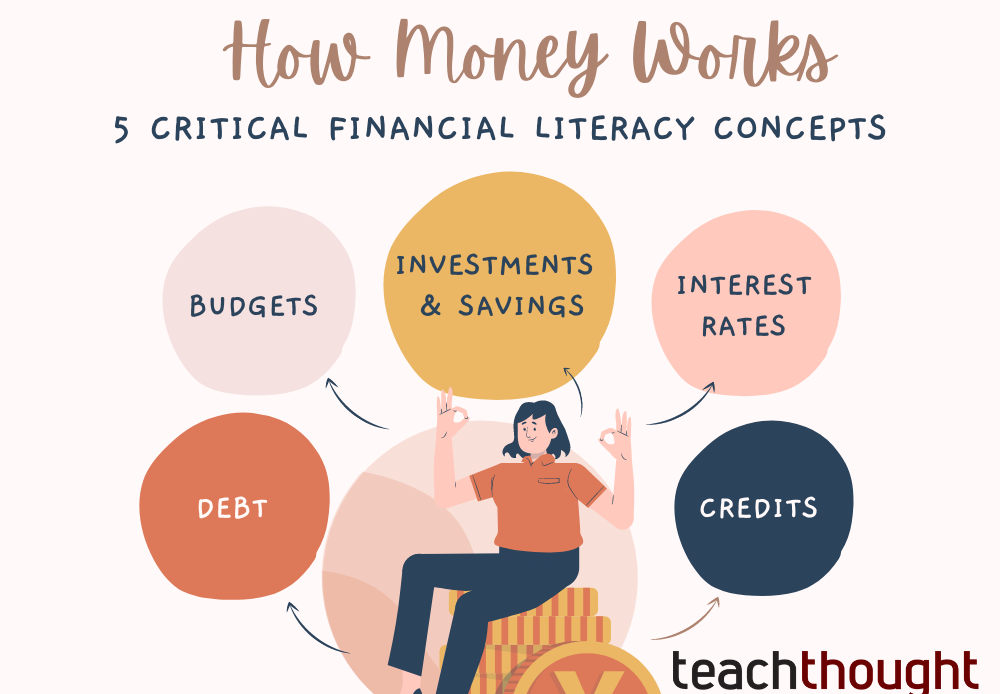

The question we seek to probe today is about the content of knowledge about money which is passed on in society, beginning from the family to school and society at large. There needs to be a way by which people are taught how money works. To merge, or minimize the poverty gap we need to create a generation of adults who are financially literate.

In general knowledge about money, most young people know about first, using money here and now, second, looking for more money desperately. This may sound satirical, but it is true.

Things will be different when young people learn the best techniques in dealing with money: budgeting, saving with goals, prioritizing – in needs and wants, deferring non-essential purchases, being in control of debts, and developing an economic lifestyle, among many others. These demand some seriousness to achieve anything from them.

However, things are different as we all feel we have the freedom to use money the way we want. We need not forget that financial responsibility sits at the heart of economic progress. Complaints about the system not supplying enough, and taxation being high have always been there, and are inherently true.

Though, it is a fact that whatever is earned could be managed better and used to achieve a little bit more in the meantime, which will be much more in a bigger time range.

Being desperate about having a lot of money in a short time, and without really making tangible efforts to work for it makes young people today locate themselves at the spinning wheels of lending companies, microfinance banks, savings and credit cooperative organizations (Saccos), organized loaning groups, collateral loaners, local ‘vicoba’, mobile money lending services, like the popular ‘songesha’ by Vodacom, and many others.

While these can be very helpful once in a while to haul difficult problems away, they become a complex entanglement and a stressor when incorporated into one’s lifestyle and survival mechanism. Many young people in our part of the world are stressed because of debts. Sometimes these debts are repayable because they were incurred with working plans of being serviced.

When one has a lifestyle of borrowing money or depending, on, or budgeting on borrowed money from different places, chances are that one fails to service all the debts in good time. There are risks of interest skyrocketing, or one begins to borrow back and forth from A to repay B, and from B to repay C, and the loop goes on.

Anyone’s need is another person’s occasion to be of service and gain something. Money lenders, especially locally or individually organized lenders can fix high interests or impossible repayment schemes which could be detrimental to those who borrow from them.

There are also ‘mwendo kasi’ (quick repayment) loans that are keeping so many people awake at night, as they are practically close to impossible to service. These are things that can be avoided when one is financially literate.

There is a markedly big cultural difference between Africa and the West as regards financial openness. In the West people openly talk about money, how much they earn per hour, per month, or year and how much they save; how much they pay bills, mortgage, car repayments, and insurance; what is expensive and what is not, what has been updated in the financial policies of their countries, what next they are going to do, for example: buying a house, selling a car, moving to a different city or country for good, and many others.

In most African countries, it is almost a normative cultural practice that we do not talk about money openly. Even in big meetings, there are often side meetings that discuss money. Things to do with family property or plans are hardly spoken about too. This is good as it works for us, yet it closes doors for sharing financial knowledge and ideas which would probably help someone not to get in trouble.

There is so much more to money than just using it in the immediate; this is something young people need to be curious about and learn. Adjusting oneself genuinely as per one’s financial resources is a sign of maturity as opposed to living without plans and savings, and in a loop of debts just to service a fake lifestyle.